- About

- Academics

- Campus

- Admission

- Beyond Classroom

- Activities and Events

- Chronicle

- Student Council

- CHAUPAL

- Abhivyakti

- Spsecmun

- Workshop

- Ethics Club

- Dramaturgy

- Intellectual?s Insight Views of toppers of SPSEC Session 2022-23

- Achievements

- COAL

principal's message

From the ancient Gurukul system to the Modern School system, from the restricted boundaries to the open global village, changes are sweeping across the world and Sir Padampat Singhania Education Centre plays a novel, imperative and exigent role in educating upcoming generations.

We are distinctive and incomparable in this respect where we sensitize minds with global outlook, believing into thinking and doing by nurturing their fearless curiosity. Academic excellence on one hand, exposure to the cultural and ideological dimensions of life on the other, help in development of young ignited minds and is set as top priorities.

Our belief is that values and character are the building blocks for long term growth, success and happiness. I wish the Singhanians to influence practices that contribute to the productive force of nation and work for the well being of self and society.

I strongly believe that “Wisdom is never enough. It is an ongoing process”.

Bhawna Gupta

Principal

ABOUT SPSEC

We are one of the biggest, most Diverse School in Kanpur.

At Sir Padampat Singhania Education Centre, schooling is not just about a theoretical approach to facts and figures – education here is rooted in a commitment to innovation and service to the community.

Set yourself apart: Our faculty constantly integrates classroom learning with the available resources and from their own experience to provide valuable skills to the students which they can carry throughout their careers. The students passing our gates emerge ready to make positive changes in diverse communities and organizations at a global level.

Engaged Model of Education: The arena of modern day education not only calls for innovative methodology in imparting instructions but also strengthening core intrinsic values of the myriad Indian culture. Our institution is a cauldron that amalgamates contemporary qualities with traditional values and also acts as a fulcrum that aids students…

SPSEC History

The foundation stone of our school was laid in 1982 by Lady Anusuiya Singhania in the memory of her husband Late Sir Padampat Singhania, an extraordinary educationalist and an industrialist with a Midas touch, whose vision and entrepreneurial acumen turned the J.K. Organization into an industrial colossus of India.

Mission & Vision

Sir Padampat Singhania Education Centre prepares students to understand, contribute to, and succeed in a rapidly changing society, thus making the world a better and more just place.

School Topper 2022-2023

We are delighted to announce the topper of SPSEC academic year 2022-23.

Class X EXEMPLARY SINGHANIANS

NIMESHA AGARWAL

98.4%

10th Class

AMBER

98%

10th Class

YASHPREET SINGH GUJRAL

97.6%

10th Class

Shubh Jain

97%

10th Class

Ananya Mishra

96.8%

10th Class

stha Chaudhary

96.8%

10th Class

Vatsala Bajpai

96.6%

10th Class

Neo Bajpai

96.6%

10th Class

Anmol Srivastava

96.4%

10th Class

Girija Dikshit

96.2%

10th Class

Aryan Dhawan

96%

10th Class

Amogh Agarwal

96%

10th Class

Ira Tripathi

95.8%

10th Class

Navya Dhingra

95.8%

10th Class

Anant Saraswat

95.6%

10th Class

Harshit Singh

95.6%

10th Class

Arpit Pandey

95.6%

10th Class

Nimesh Tripathi

95.4%

10th Class

Akshay Pathak

95.2%

10th Class

Ishi Chandra

95.2%

10th Class

Parijat Mishra

95%

10th Class

Rishi Verma

95%

10th Class

Divyash Gupta

95%

10th Class

Aryan Kushwaha

95%

10th Class

Ashish Raj Srivastava

95%

10th Class

CLASS XII STELLAR SINGHANIANS

MUBASHHIRA NAHEED

98.8%

Humanities (12th Class)

TAVISHI AGARWA

98.2%

Commerce (12th Class)

SIDDHARTH SINGH

98%

Humanities (12th Class)

Sanchi Arora

97.2%

Science (12th Class)

Navya Agarwal

96.8%

Commerce (12th Class)

Chitranshi Agarwal

96.8%

Humanities (12th Class)

Suhani Kapoor

96.4%

Commerce (12th Class)

Aadi Shukla

96.2%

Commerce (12th Class)

Harshpeet Kaur

96.2%

Commerce (12th Class)

Krish Hada

96.2%

Science (12th Class)

Sameeksha Bajpai

96.2%

Humanities (12th Class)

Aditya Anand

96%

Commerce (12th Class)

Shivi Singh

96%

Science (12th Class)

Anandita Vishnoi

96%

Science (12th Class)

Akshara Shukla

96%

Humanities (12th Class)

Shweta Agarwal

95.8%

Science (12th Class)

Vansh Bhatia

95.4%

Science (12th Class)

Aryan Shakya

95.4%

Science (12th Class)

Vikalp Yadav

95.2%

Commerce (12th Class)

Ojasvita Yadav

95.2%

Humanities (12th Class)

Dhruv Bardeja

94.8%

Commerce (12th Class)

Akhand Pratap Singh

94.8%

Science (12th Class)

Tanishka Dikshit

94.8%

Science (12th Class)

Gaurika Dixit

94.6%

Commerce (12th Class)

Vyoma Kalra

94.6%

Science (12th Class)

Academic

Enrol for a promising future at SPSEC innovative labs.

Our Innovative labs programs enrich the students with innovative implications in every sector of life. We equip each student with a highly acclaimed knowledge tool kit that prepares them for future.

Achievements

Exclusive Video

City topper Jyotsna Mishra student Scored 99.4% (Humanities) 2nd Rank in Allahabad Region shares her kind thoughts on her incredible performance.

Exclusive

Announcement

To keep a tab on the latest news at our prestigious school, kindly click on the following links.

Testimonials

What they say about us

Mother of Amaayra Dwivedi Class- I & Shivay Dwivedi Class- Bloom

SPSEC has a curriculum that stimulates creativity and encourages independent learning. The teachers, learning environment, and security are all top-notch. The improvements that I see in my kids are significant, and their academic and social skills improved in just a few months. The teachers are patient and give adequate attention to every child. The teaching at SPSEC is interactive: strengthening the problem-solving and critical thinking of the students. School safety is always a priority at SPSEC and I feel safe leaving both of my daughters for almost half of their day.I can say to anyone who is still confused about choosing the best education for their children, look no further than SPSEC.

Mother of Seerat Kaur - Class I

"School is a building with four walls and a future inside." I am a proud mother who is extremely happy getting my child admitted to the BEST school in the city...SIR PADAMPAT SINGHANIA EDUCATION CENTRE. My son is always happy to go to school and full of smiles & confidence when we pick him up back. I attribute this to the exemplary teaching and community feel of the school. The teachers are extremely helpful, caring and well-organized. My child is very comfortable talking and expressing himself. My job as a parent has become easier than before in the process of nurturing him. The education pattern here is systematic which has made academics more comprehensive for my child. As a parent, I am regularly updated with the ongoing classwork and activities through the Google platform. The school offers a plethora of outdoor and indoor activities, all of which my child loves to participate in and have gained an appreciation for each. I am confident that this school has a solid foundation for their learning path and that they developed a true love for learning.

Mother of Gursanjh Singh Bedi

Today I feel so proud because I have got a chance to express my feelings about S.P.S.E.C. First of all, I would like to express my heartfelt gratitude towards the honourable Principal Madam, Ms Bhawna Gupta, teachers and the school management who are the pillars of S.P.S.E.C. I feel so lucky because I have been part of this sweet heaven on Earth that prepares small minds for great tasks. It is the real place where students learn discipline, dignity and dedication. S.P.S.E.C. provides the best environment where the students also learn manners and etiquette. The school has nurtured the potential and talent of our children. We are extremely glad for all that has been rendered. S.P.S.E.C, indeed makes every student aims and helps them to realise their goals and strives for perfection. In the end, I wish that the school touches the heights of success that no one can even imagine.

Mother of Mustafa Siddique Class V & Maham Siddique Class I

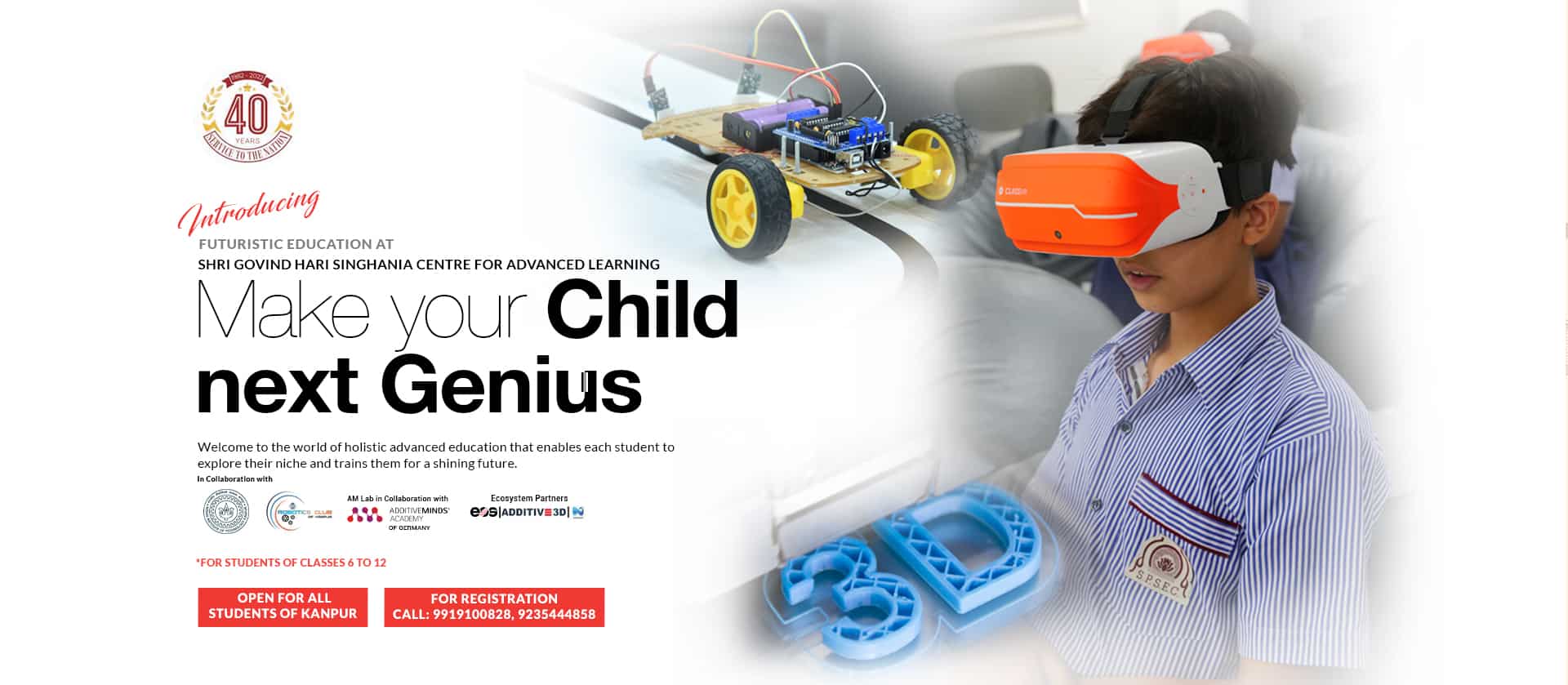

Parents always want the BEST for their children. Admitting my child KUSHVEER SINGH (Grade- II) to S.P.S.E.C, the BEST school in Kanpur was one of my BEST decisions for him. It is not just a school, but it is the "PERFECT PLATFORM" for the overall development of the child. Winning the most coveted award by EducationalWorld-India School Rankings 2022-23,compliments my above statement. S.P.S.E.C always thrives on upgrading its educational system with the dynamically changing environment. S.P.S.E.C offers a lot more beyond classrooms. A buffet of sports to choose from, a lot to learn aesthetically and an introduction to pioneer ventures in the school like Shri Govind Hari Singhania Centre for Advanced Learning has driven the institution far above others. Also, the school works on teaching ethical values to its children through various types of activities. With all these things under one shed, we need not worry about our children's overall development. My sincere gratitude towards the wonderful team of S.P.S.E.C. Keep Growing, Keep Shining.

Mother of Kushveer Singh - Class II

I am quite awestruck to see the teacher's passion and the way they put in their efforts to mould the children. It gives me great satisfaction and confidence to see that my child is being guided by such mentors. I can completely understand how challenging it is for teachers to handle a class full of students in an effective way when the students have just returned to school after 2 years gap due to the COVID-19 pandemic. All credit goes to the management, Principal and teachers of S.P.S.E.C who have handled the students and their temperament so well. The lessons explained are made easier through smart classes. Subject Enrichment Activities performed in each subject helps to build the interest of students in the subject and enhance their skills and knowledge. The school has also helped in building the vocabulary and the spoken skills of the students with the help of verbal activities such as building Speakers Corner, Monthly Blog writing activities etc. The other co-curricular activities have also helped the students to develop their interest indifferent fields such as plantation activity, plays, non-fire cooking, craft-based activities relatedto different events and occasions etc. The school has contributed a lot to enriching the aptitudes of the children and has taught them moral values and discipline and their importance in life.

Mother of Ruhaan Magan - Class-Ill

Imagine a school that your child eagerly looks forward to attending every day; I am sure your imagination will just stick to Sir Padampat Singhania Education Centre. SPSEC is a place where learning is a pleasure and fascinating. The family-like environment exemplifies that students develop a strong bond with everyone. Teachers are always available and are genuinely concerned while nurturing each child's potential. They are also very open to parental feedback and make sincere efforts to implement recommendations to a great extent. The school maintains strong safety standards and an impressive level of hygiene. Feedback sessions with teachers are not only about how the child is doing in her/his studies but about who the child is, and about the social and emotional development of the child. It is a school which is honestly child-centric in every sense of the word. A school where our children grow intellectually, physically, socially, emotionally and spiritually - as fully functioning human beings. A happy school of happy children! Thank you SPSEC family for everything.

Mother of Neil Yadav - Class- Ill

SPSEC never fails to create a warm and welcoming environment for its students and parents. The school fraternity truly invests in the growth of children as learners. They try to bring out the best in every child by tapping into their individual strengths. I feel proud to be a part of such prestigious institution.

Class - VIII B

SPSEC provides the exposure and knowledge to the students in the best possible ways. One to one support to each student is provided by the mentors. The teaching methodologies act as a link between the modern and traditional ways of learning. The art of Modern Science like Robotics, 3D Printing etc. is taught here thus assisting the students to be ready for the future by upgrading their technical and aesthetic skills.

Class - VIII C

Greetings to All ! The best thing that has happened to me is to receive education and guidance in an institution known for its excellence. Hailing from another school and getting into new discipline was a strange start . Since then, the time seems to have passed in a jiff. In this time though, I have become a whole new, better version of myself, from discovering my latent potential to strengthening my flaws, from having stage fright to absolutely loving the spotlight, the newfound confidence has been growing every single day. It has only happened because of the foundational and excellent mentorship of the educators of the school and their willingness to give each and every one the chance to explore themselves. Without them, I wouldn’t know where I would take the stance in this world. The school has been particularly focusing on developing amenities and infrastructure so that the SINGHANIANS learn only the BEST from the outstanding ecosystem. Upgrading the infrastructure to accommodate the vocational and educational needs of the students, the school has all the facilities to fulfil such needs on its part. Throughout the years, I have been increasingly participating in cultural events as well as focusing on academics. But this wouldn’t have been possible if the school hadn’t inculcated in me the virtue of multi-tasking and being competent. The words are falling short to describe my heartfelt gratitude towards the school and the teachers who are an integral part of my life. With pride I call myself a SINGHANIAN and the legacy of school will be cherished throughout in my life.

Class - XII

We Work Hard To Prepare Every Student For Their Professional Life

Subscribe Our Newsletter

Stay updated with the latest development and event by subscribing our Newsletter.

Quick Links

Support & Contact

-

Call: (0512) 2218222

(+91) 9235444858 - Email: school@spsec.co.in

- FAX: (0512) 2218283

Copyright – 2024-25. Sir Padampat Singhania Education Centre. All Rights Reserved.

We have never seen teachers wearing capes, but we have always seen their superpowers. This stands tall for the teachers of SPSEC. My deep sense of appreciation to the entire staff members of the SPSEC for striking the rightful balance between academics and co-curricular activities. I feel extremely elated to see my child blossom in this school under the able guidance of educators. My kids' communication and social skills have enhanced a lot due to the range of classroom activities conducted regularly. The school is making relentless efforts towards nurturing children and honing various skills and always keeps striving to achieve a wonderful environment for the all-around well-being of the students.